5 Reasons Gene Therapy Companies are Vital to the Future of Biopharma

Contributing Author: Gina Hagler

Pharmaceutical companies have been developing therapies to treat or prevent disease since the end of the 19th century. Chemical compounds are used to create these drugs and medications. The resulting small-molecule drugs – think aspirin – are ingested, metabolized and circulate through the blood. Because it’s not possible to target these drugs, they have a systemic effect that can lead to unwanted adverse events. Biopharma companies use genetic material to create genomic – gene, cell, and gene editing – treatments that repair genetic mutations or introduce functioning genes to take the place of or inhibit the mutated gene. These treatments can be targeted, causing minimal unwanted side effects.

Since the mapping of the human genome was completed in 2003, interest in biopharmaceuticals has increased. To date, several gene therapies have gone through trials and received approval from the FDA, with hundreds more proposed therapies in the pipeline. In 2020, FDA published guidance for gene therapy trials, signaling that a significant change in traditional healthcare and drug development is underway. As a result, gene therapy companies are vital to the future of biopharma for 5 reasons.

1. Small-molecule drugs alone are not effective treatments for genetic diseases.

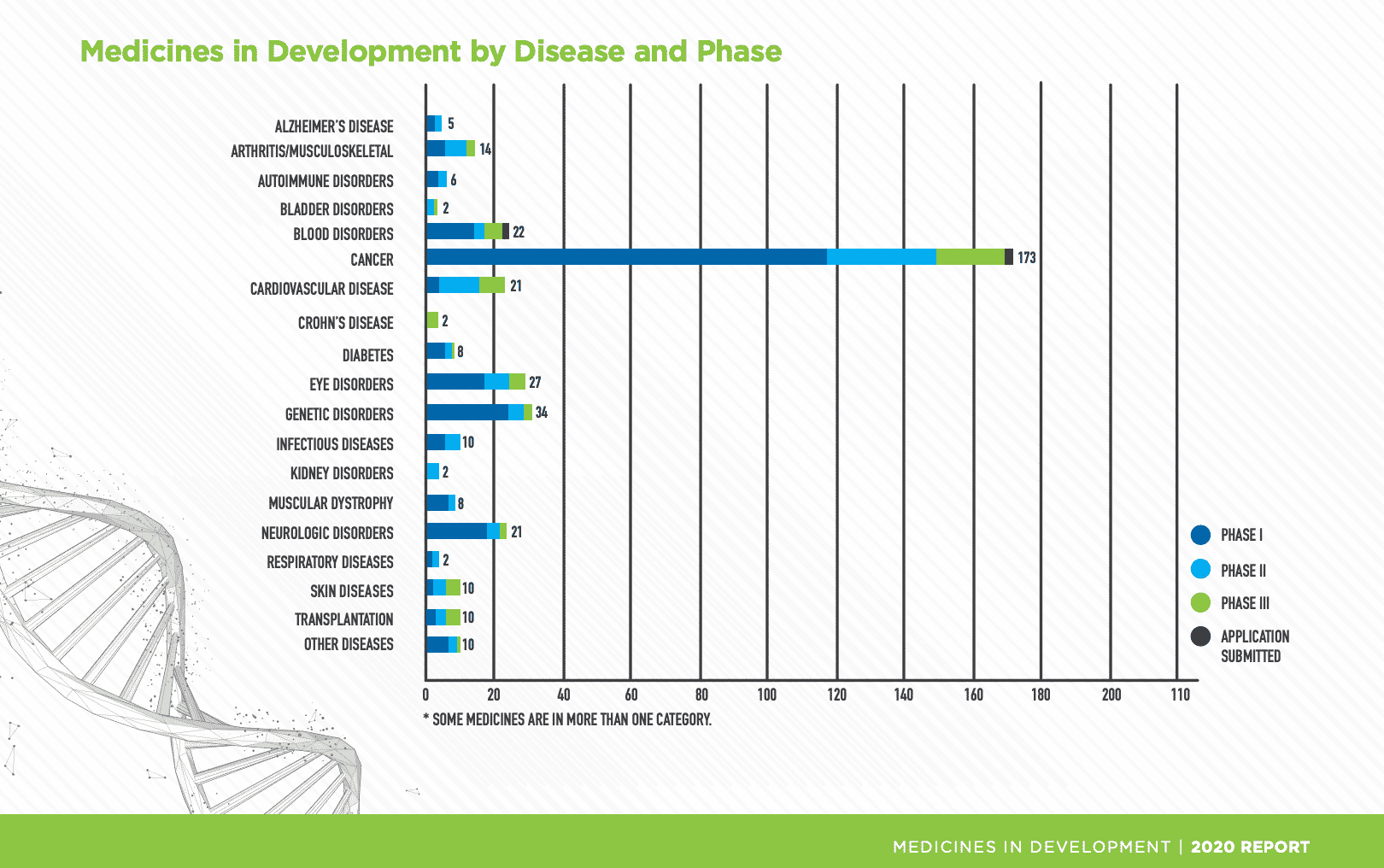

Genetic diseases are caused by one or more mutations in a person’s genetic code. Small-molecule drugs can alleviate the symptoms, akin to aspirin and headaches, but they can neither repair, replace, nor inhibit the function of the mutated gene. In other words, traditional pharma drug development can only provide palliative treatments for genetic disorders, in the same way that an error in a computer code cannot be fixed by switching out components; it can only be fixed by correcting the code or writing a subroutine that bypasses that segment of the code. There are many small-molecule drugs that are in development for use with targeted delivery and/or in conjunction with RNA, and these will have their place in the market, yet with nearly 400 gene and cell therapy treatments in development in 2020 (Fig. 1), pharma is clearly looking to gene therapy for next-generation, new treatment options.

Fig. 1 Cell and Gene Medicines in Development by Disease and Phase

[PhRMA Medicines in Development 2020 Update - Cell and Gene Therapy]

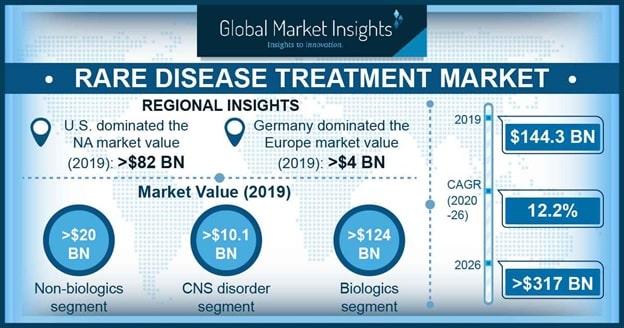

2. Biopharma treatments fulfill an unmet need for rare disease patient populations

PhRMA estimates that only 5% of rare diseases have an approved treatment option, Global Market Insights forecasts a rare disease treatment market of $317 billion by 2026. (Fig. 2) For those with Duchenne muscular dystrophy, hemophilia, spinal muscular atrophy, and nearly 7,000 other rare diseases, the new therapies possible through the use of viral vectors, or gene editing with CRISPR or other modalities, will be life-changing. Each individual rare disease affects a small population, but the more than 350 million individuals worldwide represent a significant opportunity for life science companies. As more work is done and more about individual genes is understood, there may be opportunities to leverage off the work done for one disease to treat another, reducing the cost of the treatment in the process

Fig. 2 [Global Market Insights, 2020]

Within the biotech biopharmaceutical pipeline for rare diseases (Fig. 3), genetic disorders (148/596) represent 24% of the medicines in development. With the cost of individual “one-and-done” treatments, in which one treatment is anticipated to have a lifelong effect, in the millions of dollars, these rare disease candidates can be lucrative. There is also some early evidence that treatments for one genetic disorder may apply to others. If this proves to be so, modification of existing treatments will add to the profitability of new treatments for the companies bringing them to market.

3. Treatment of cancer using gene therapy holds promise

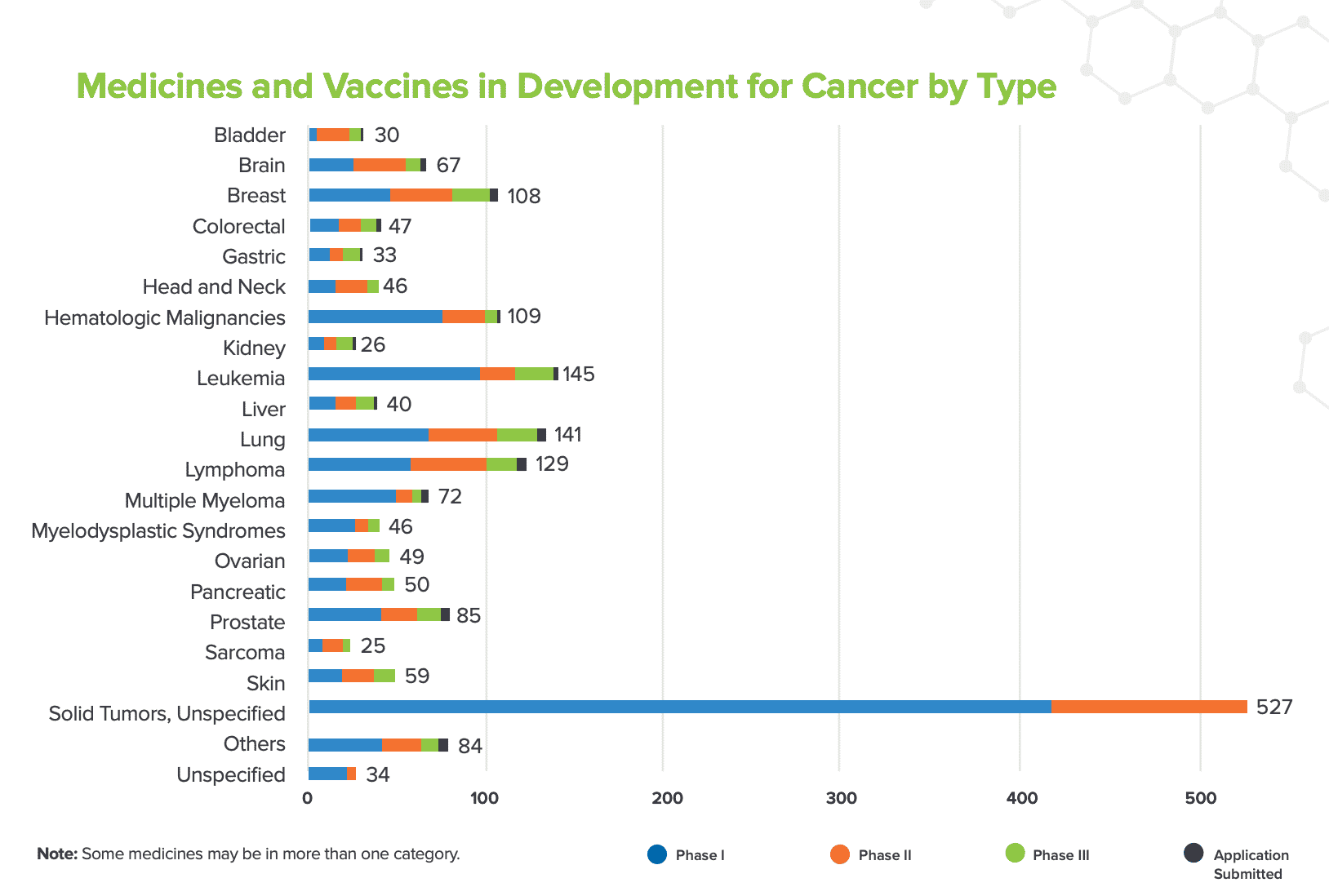

Cancer is the second leading cause of death worldwide with 17 million new cancer cases worldwide in 2018, according to the International Agency for Research on Cancer (IARC). Of the 400 medicines for cell and gene therapy in 2020, (Fig. 1) nearly half (173/387) are for cancer. The traditional form of treatment for cancer is chemotherapy, which introduces toxins into the body without the ability to act on one specific target. As a result, severe side effects are common. Efforts are being made to control the area affected by the chemo through a variety of methods. However, a 2006 paper from Marshfield Clinic cites gene transfer as “a new treatment modality that introduces new genes into a cancerous cell or the surrounding tissue to cause cell death or slow the growth of the cancer. This treatment technique is very flexible, and a wide range of genes and vectors are being used in clinical trials with successful outcomes.”

The PhRMA Medicines in Development 2020 Report for Cancer treatments includes more than 1,300 medicines and vaccines biopharmaceutical research companies have in clinical trials for cancer. (Fig. 3) Included in these are treatments for several types of leukemia, lung cancer - the leading cause of cancer death in the U.S., lymphoma, breast cancer, prostate cancer, multiple myeloma, brain tumors - including gliomas, and ovarian cancer.

Fig. 3 [PhRMA Medicines in Development 2020 Update - Cancer]

4. Biopharma is far too lucrative for traditional pharma to overlook

Forecasts for the biopharma industry from sources within the industry as well as those tracking the industry call for robust growth, reaching global market revenue of between $446 billion and $526 billion by 2025. The ability to sequence an individual’s genes brought the ability to pinpoint the site of the problem in genetic disorders. This information led to a number of potential approaches for new gene therapy products that could be taken to correct or override the error. More and more of these gene therapy approaches are now reaching the clinical trial stage.

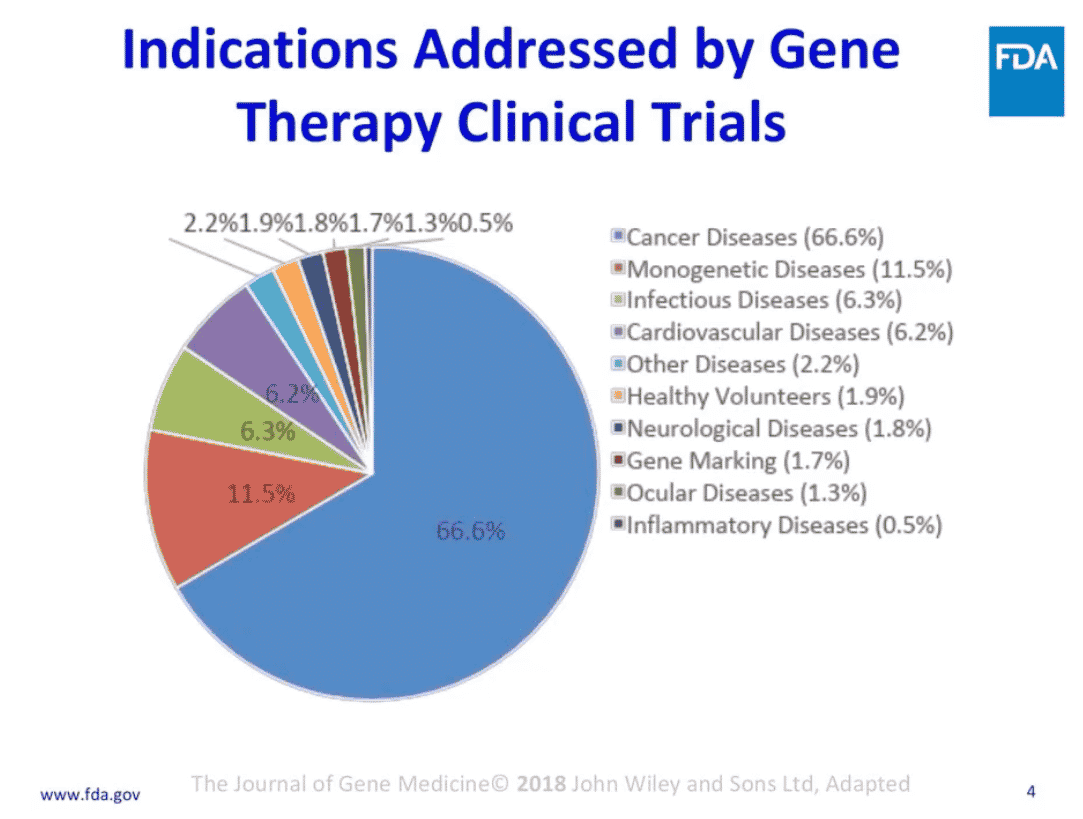

Fig. 4 [FDA, 2018]

In 2018, the Journal of Gene Medicine cited an FDA chart that described the indications being addressed in gene therapy clinical trials,(Fig. 4), ranging from 67% for cancer diseases to .5% for inflammatory diseases. The trials for cancer and monogenetic diseases, comprising nearly 80%, are of special interest because they signify a population with an unmet need since there are no effective treatments at this time.

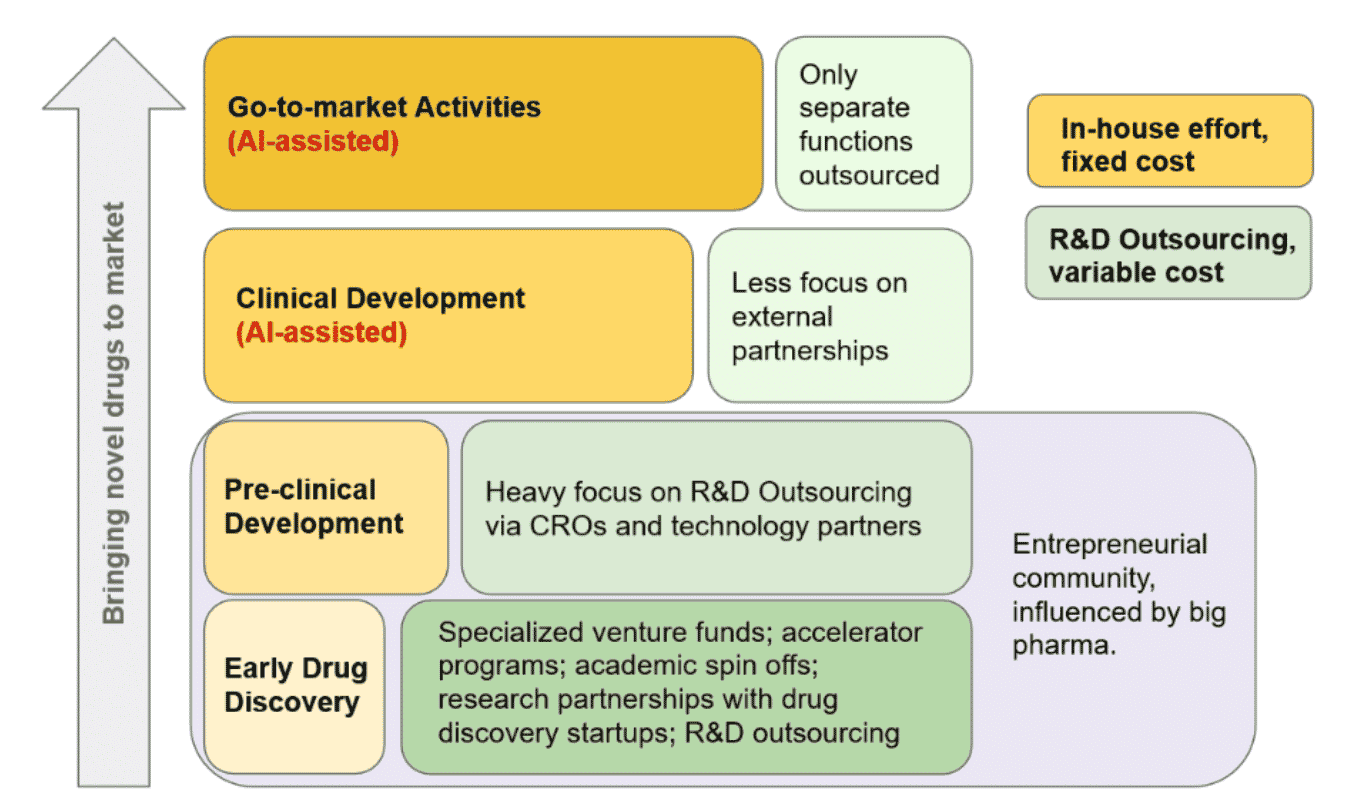

5. Mergers and acquisitions are an expedient vehicle for entry to biopharma

Traditional, big pharma companies can enter the biopharma area by hiring their own talent, creating infrastructure, and dedicating the time required to build a pipeline of promising cures. Alternatively, they can form external partnerships with drug discovery startups or academic institutions, acquire smaller firms with an approach and proof of concept and take it the rest of the way, or outsource R&D activities. In conjunction with entry into genomic medicine, BiopharmaTrend envisions a necessary revision of the current pharmaceutical business model in which the R&D is done without a specific target (Fig. 5), resulting in what Standish Fleming points out is a “high-quality, low-volume, high-cost strategy” of early drug discovery.” This model is inherently costly since R&D is costly even when a product results, much less when the R&D effort fails to yield a marketable result. The new model BiopharmaTrend describes will be a “low-cost, high-quantity strategy” with biopharma at the heart.

Fig. 5 BioPharmaTrend’s Low-Cost, High Quantity Strategy

[Biopharma Trend - The Evolution fo Pharmaceutical R&D Model, 2020]

Bottom Line

Gene therapy is vital to biopharma. Gene therapy offers advanced therapy and treatments where none have been viable with traditional pharma and small-molecule drugs. Gene therapy also provides an opportunity for big pharma to enter the estimated $317 billion global rare disease market by meeting the needs of the 350 million people with genetically-based rare diseases. Gene therapy is also vital to biopharma because of the new, targeted approaches it brings to cancer treatments. With a forecast for a global oncology/cancer drug market of $176 billion by 2025, there is room for many players - but they will require gene therapy capabilities to access and hold a position in that market. With a forecast of about $500 billion by 2025, the biopharma market overall is equally attractive. The FDA recorded a significant number of diseases - from cancer to inflammatory diseases - addressed by gene therapy clinical trials in 2018, with a greater number forecast in the coming years. Finally, recent partnerships or mergers with gene therapy startups have proven to be the fastest way for big pharma to enter the growing and lucrative biopharma sector.

Take Away

In 2020, the FDA issued regulatory guidance related to the cellular and gene therapy industry. Release of the guidance is a significant indicator that regulators anticipate an increase in preclinical activity and requests for clinical trials in the coming years. A full listing of the guidance documents is available.