Technology Transfer, A Catalyst For Gene Therapy Startups | The Spark Therapeutics Example

Contributing Author: Gina Hagler

The ability to consistently bring treatments and cures to market depends upon a company’s capacity to create and sustain a successful product development pipeline. Traditionally, pharmaceutical companies have developed small molecule medicines such as Zantac or Lipitor to treat conditions such as heartburn or high cholesterol through a trial and error process that begins without the end in mind. With gene therapy companies, a specific target is often the starting point for cutting-edge, next-generation treatment options. These treatments employ proven techniques such as viral vectors to bring about a commercial product to act on a specific target. Whichever approach is taken, the research portion of the drug development process is time-consuming and costly. With the increased interest in gene therapy, much of the research is performed at the university or research organization level. When a treatment approach shows promise, intellectual property that has been developed at the university is sub-licensed to a corporate entity to further the development process. This use of technology transfer is fueling the current gene therapy boom.

The Path to Drug Approval Via Technology Transfer

The path through drug discovery and approval via technology transfer is one in which those specializing in tech transfers or part of the organization's technology transfer office arrange for cooperative research and development agreements that safeguard their intellectual property rights. The experience of Spark Therapeutics exemplifies a successful tech transfer. In this article, we will explore the pathway that their product, Luxturna (voretigene neparvovec-rzyl), navigated to become commercialized.

01. Academia

In 2013, the Children’s Hospital of Philadelphia (CHOP) technology transfer program arranged the transfer of developing gene therapies for unmet needs in genetic diseases, including blindness, hemophilia, lysosomal storage disorders, and neurodegenerative diseases. The transfer resulted in the formation of Spark Therapeutics.

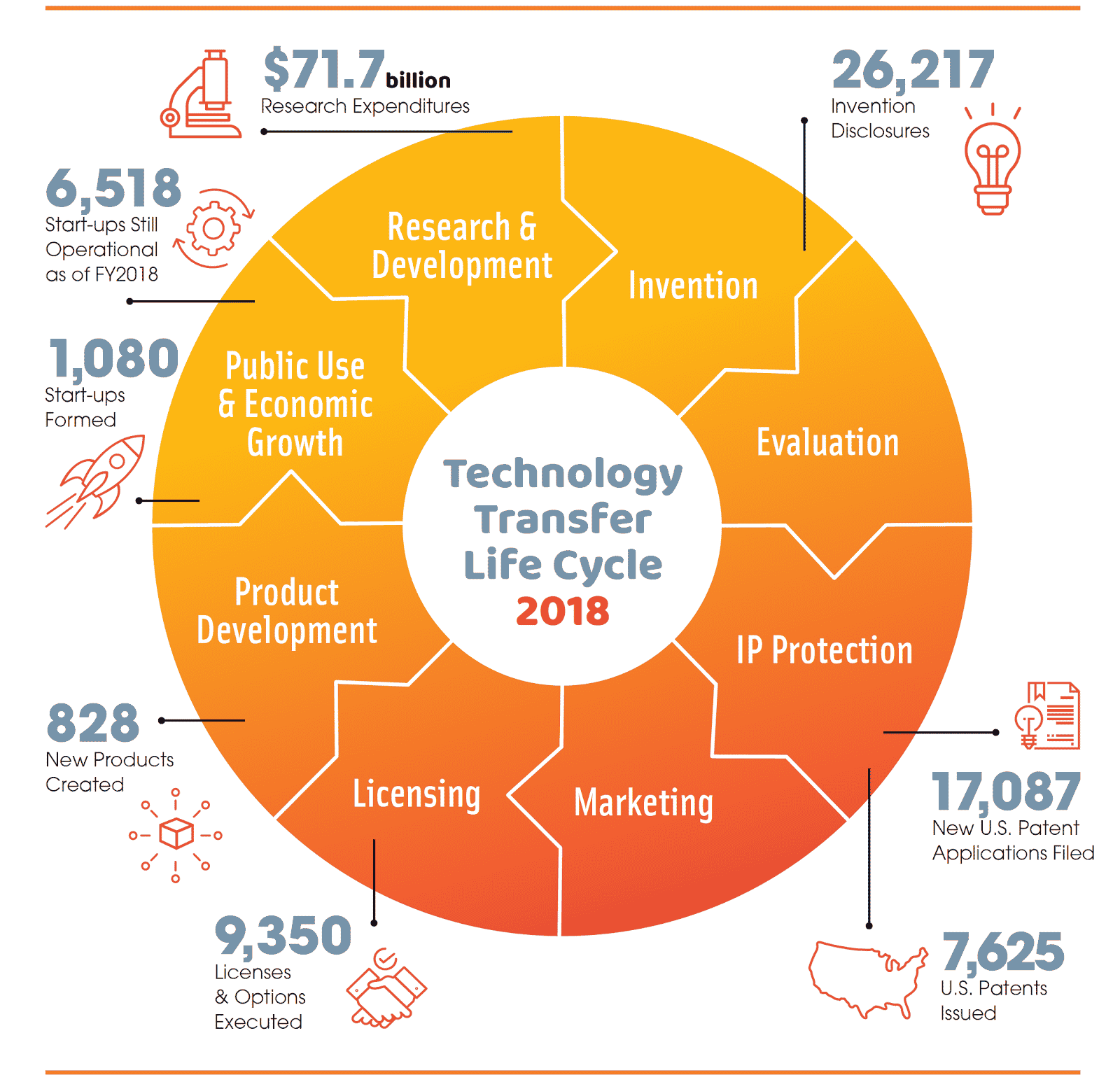

The arrangement between CHOP and Spark is part of a growing trend due to the reemergence of gene therapy and the role played by technology with commercial potential that is the result of research in academia. Through the technology transfer process, universities and other research institutions arrange for intellectual property protection, the establishment of start-ups, or other licensing and sharing agreements that will advance the research from the early stage through the development pipeline. In 2018, $71.7 billion in research expenditures for health and other technologies resulted in an impressive number of inventions, U.S. patent applications filed, and other work products as seen in Fig. 1.

Fig. 1 Technology Transfer Life Cycle 2018, ATUM, 2020

02. Start-up Companies

Start-up companies are nothing new in bio. Biotech company Spark Therapeutics was founded in March 2013 as a commercial company to develop the technology and know-how accumulated at CHOP. Their vision was to create a world without genetic disease. Their mission was to discover, develop, and deliver the treatments that had been “unimaginable - until now.” Spark used adeno-associated virus (AAV) vectors to deliver their gene therapy to such targets as the cells in the retina, liver, and central nervous system. They produced the AAV vectors in-house and brought one product, Luxturna (voretigene neparvovec-rzyl), the first gene therapy for a genetic disease in the U.S., to FDA approval in 2017 and EU approval in 2018.

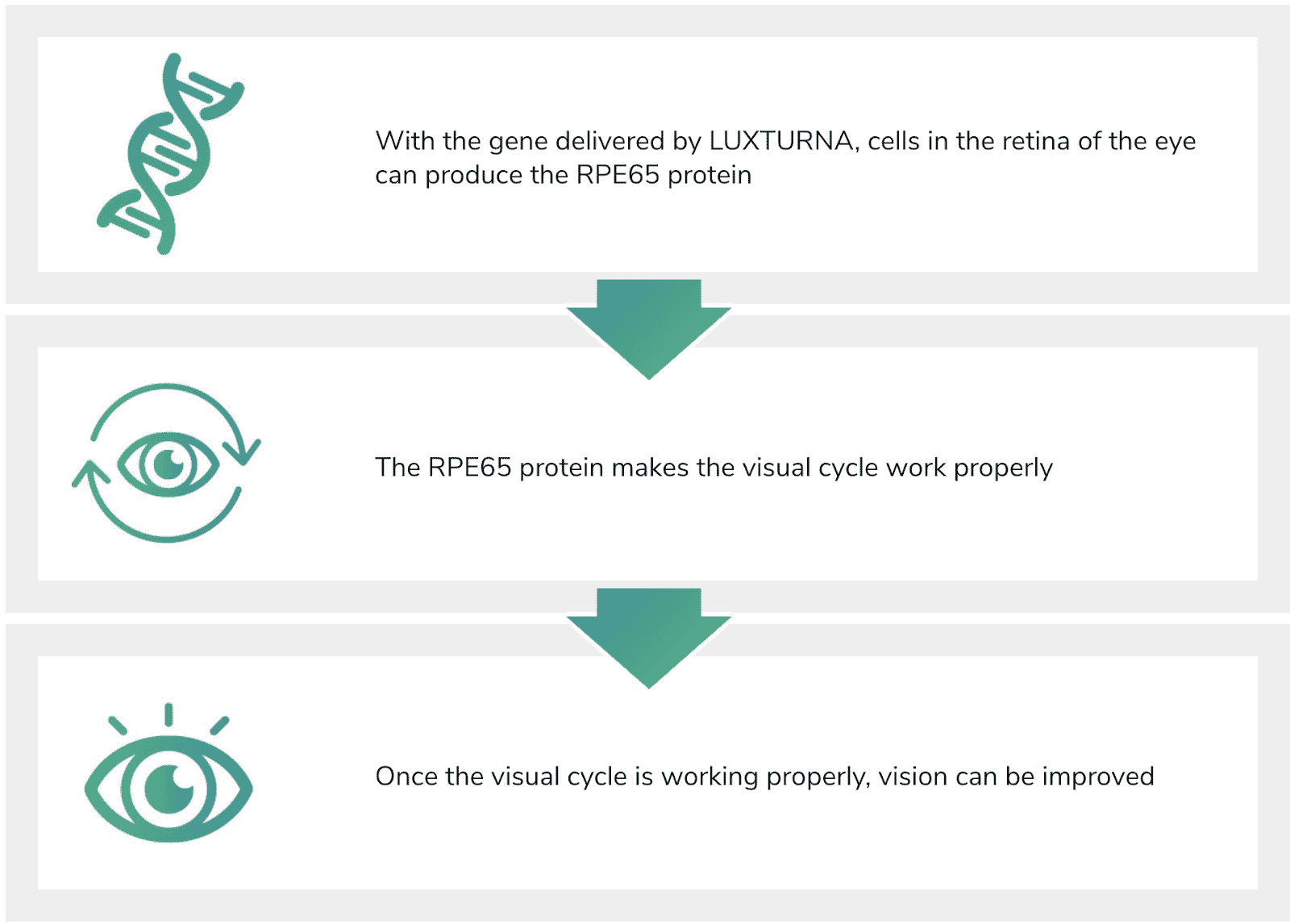

Fig. 2 The mechanism for vision improvement through the use of LUXTURNA.

Source: LUXTURNA, 2021

As illustrated in Fig. 2, when delivered to the cells in the retina of the eye, LUXTURNA produces the protein required to correct the damaged visual cycle. Once the cycle is corrected through this retinal treatment, vision can be improved.

03. Mergers & Acquisitions

It is not unusual for successful smaller companies to be acquired by or merge with larger pharmaceutical companies in order to expand the range of therapies offered by the larger company. This was certainly the case for Spark, which was acquired by Roche for a total of about $4.8 billion in December of 2019. Spark is viewed as a good fit for Roche since its gene therapies for hemophilia A, SPK-8011, complement Roche’s own Hemlibra.

The acquisition was made after FDA approval for Spark’s LUXTURNA indicated that Spark had a viable approach that could result in approvals for other therapies in their development pipeline. This attracted the attention of Roche Holding AG, the Swiss multinational healthcare company with a market cap of about $280 billion as of April 2021.

Bottom Line

The technology transfer process can work to the benefit of both the organization doing the preliminary research and the company or companies involved in the next phases of drug development. As reported by Fierce Healthcare and Advisory Board on February 27, 2017, Children’s Hospital of Philadelphia (CHOP) was able to turn its $33 million investment in Spark Therapeutics into $446 million. The Roche acquisition of Spark made it possible for the hospital to not only recoup its initial investment in Spark but also to realize a sizeable gain that can be used to fund new research projects.

Take Away

The evolving drug development paradigm for gene therapy products is dependent upon the initial investment of universities and other research institutions funded by the government. These entities, which traditionally have focused on research without a specific interest in a financial return, now have a significant incentive to explore areas of interest with potential for commercialization. With a view to an eventual acquisition, merger, or another form of financial remuneration, a question of growing concern is whether research will be conducted in its purest form and if that is even the right thing to do.