A SPACtacular Way to Go Public

Contributing Author John Vandermosten, Senior Biotechnology Analyst

What Is A SPAC Anyway?

2020 turned out to be a fantastic year for private companies to go public. In a hot year for initial public offerings (IPOs), one type of IPO called a Special Purpose Acquisition Company or SPAC has stolen the spotlight. While they have raised billions, SPACs have no revenues, no operations and no products. But what they do have is an experienced acquisition team that can identify good candidates ready to move into the public markets.

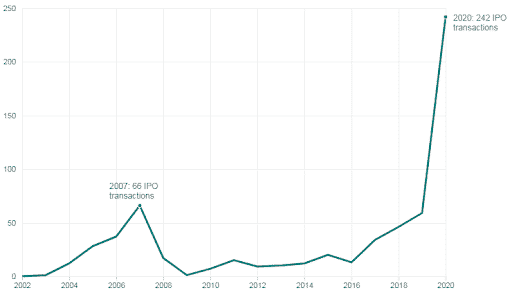

SPACs have been around for quite awhile, first emerging in the 1980s as “blank-check” corporations that had a poor reputation in the junk bond decade but provided a useful tool for bringing a private company public without an IPO. After a multi-year quiescent phase, SPACs began to increase in number in the early 2000s followed by an abrupt decline during the crisis. Since 2016 we have seen another steady rise in the use of this flexible vehicle surging to an all-time high last year. In 2020 there were 248 SPAC IPOs accumulating over $83 billion in proceeds.1 The pace has been even faster in 2021 with 67 deals and over $19 billion gathered in the first 22 days of the year.2

Exhibit I – SPAC Transaction History3

The SPAC does not have a specific business plan and its sole purpose is to acquire an unidentified company or companies. A sponsor, which can be an individual or a group with specific expertise in mergers and acquisitions, creates a shell company with the objective of finding a specific type of company in a certain geography. The shell company trades as public equity following the IPO process. After the SPAC IPO takes place and funds are received, the majority of proceeds are placed in an interest-bearing trust account composed of short-term cash instruments. SPAC investors purchase a common share usually priced at $10 and receive an out of the money warrant, commonly with an $11.50 exercise price. The SPAC security has a finite life of two or three years following the IPO, during which time the SPAC sponsor will search for a deal. If no deal is completed, the funds are returned to investors. The deal period can be extended with a favorable vote by the shareholders and if investors don’t like it, they can get their money back. If a deal does take place, shareholders will get to vote on the transaction and other funds will usually be sought to close.

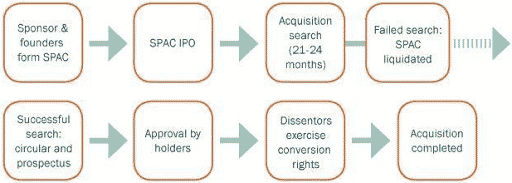

Exhibit II – SPAC Lifecycle4

There are multiple phases to the life of a SPAC. The first is the IPO phase. The new entity transits the typical IPO process by filing a registration statement with the Securities and Exchange Commission (SEC), signing underwriting agreements, engaging counsel and auditors and conducting a road show. The next phase involves the target search where due diligence is performed, additional financing is identified, proxy and tender offers are constructed and the merger intent agreement is signed. Periodic SEC filings are required after the entity goes public. In the last phase, the acquisition agreement is announced and required documents are filed. The deal is presented to SPAC investors and approval is obtained. Shareholders who disapprove can exit with their invested cash and supporting shareholders along with the sponsor will close it often aggregating other sources of capital.

SPAC Characteristics

Sponsors usually search for deals that are at least 80% of the SPAC assets size. The size of the deal can expand up to four or more times SPAC assets to reduce dilution though the access of other financing such as private investment in public equity (PIPEs), debt or equity raises. SPACs generally target a specific industry and geography, frequently in the healthcare or technology sectors.

Benefits for the Target

SPAC transactions can be a capital raising alternative to an IPO. The private company benefits from a more rapid access to the public markets and a less burdensome process. SPACs can also provide a pathway to become public when the IPO market closes. The SPAC does not have any of the baggage that comes along with a reverse merger such as historical liabilities, irrelevant prior filings and a connection to what was likely a failed company. Even if a private firm does not elect to be acquired by a SPAC, their mere existence improves the competitive environment for accessing public markets. Banks have traditionally held the only set of keys to accessing the equity markets. For many gene therapy and other life sciences companies, the dilution from a crossover round followed by an IPO makes the SPAC a more strategic choice.

Benefits for Investors

In many cases, retail investors do not have access to in-demand IPO opportunities, which have been routinely reserved for institutions or the well-connected. The small investor also lacks access to investment advisors from hedge funds, private equity and venture capital that have the skills, reputation and connections to identify and advance the most attractive candidates. The SPAC can address these shortcomings and provide liquidity that is frequently not available with other sophisticated investment vehicles. The SPAC usually has a life of over a year, allowing for tax efficiencies if gains are achieved. The downside for investors is also limited, as the proceeds are kept in cash. If the vehicle is not able to consummate a transaction or the investor does not like the deal, funds are returned with interest. Depending on how it is structured, acquiring a private company via a SPAC can result in less dilution than the traditional IPO route because it requires fewer steps.

Some Risks

While the SPAC provides protections for investors and allows them to redeem if they do not support the announced deal, there are some drawbacks. Shareholder approval is required before the combination can be consummated and if insufficient shareholders elect to participate, there may not be enough funding. SPACs can quickly take advantage of an opportunity that presents itself. However, the less visible and accelerated closing process may circumvent important due diligence. The SPAC also adds a layer of dilution where the SPAC sponsor gains ownership in the entity at a discount. Sponsors of the SPAC are usually entitled to a promote fee, frequently 20%, diluting the upside. Other fees, such as the SPAC’s IPO finance, legal and filing fees also take a layer off of the top. Most of the SPAC-specific risks accrue to the SPAC equity owner rather than the target being acquired.

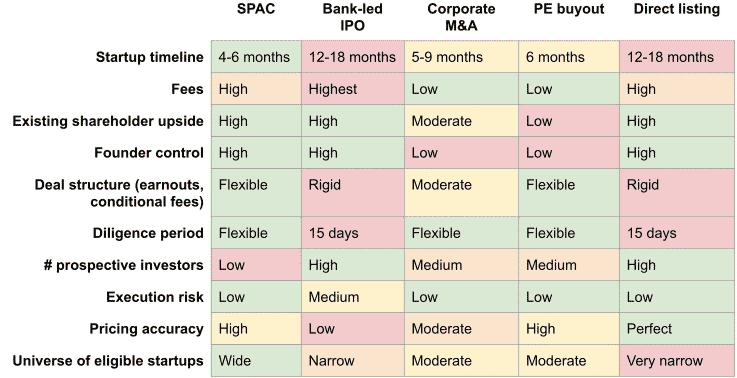

Comparison of SPAC Pathway vs. Alternatives

There are a variety of ways a private company can realize value for its shareholders. IPOs have been popular this year. In other periods M&A or a buyout from private equity is a monetization event. A direct listing or reverse merger with a shell company can also move a firm into the equity markets. Below we borrow a graphic from John Luttig at Founders Fund which highlights some of the strengths and weaknesses of common monetization events.

Exhibit III – SPAC vs. the Alternatives5

Healthcare SPACS

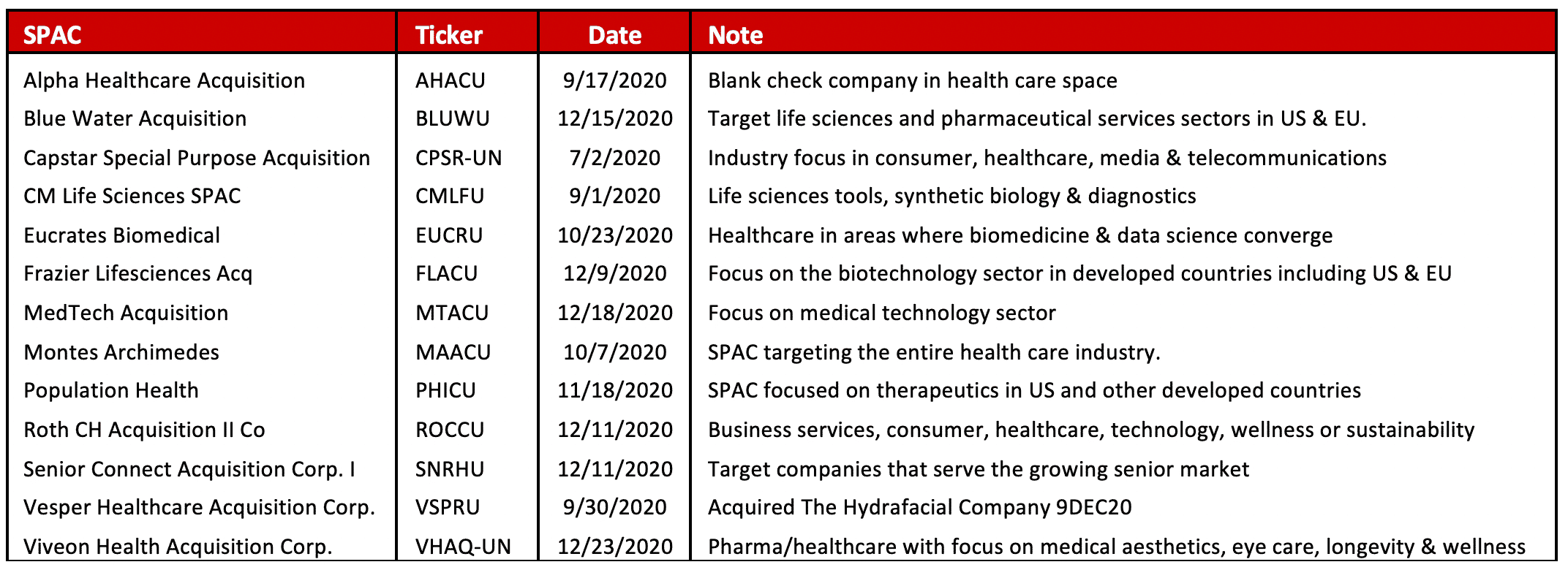

According to STAT News, there were 33 healthcare focused SPACs that went public in 2020. This does not include industry agnostic SPACs which may consider healthcare candidates. Below we summarize a few of the more visible SPAC IPOs this year with a healthcare focus.

Exhibit IV – 2020 Healthcare SPACs

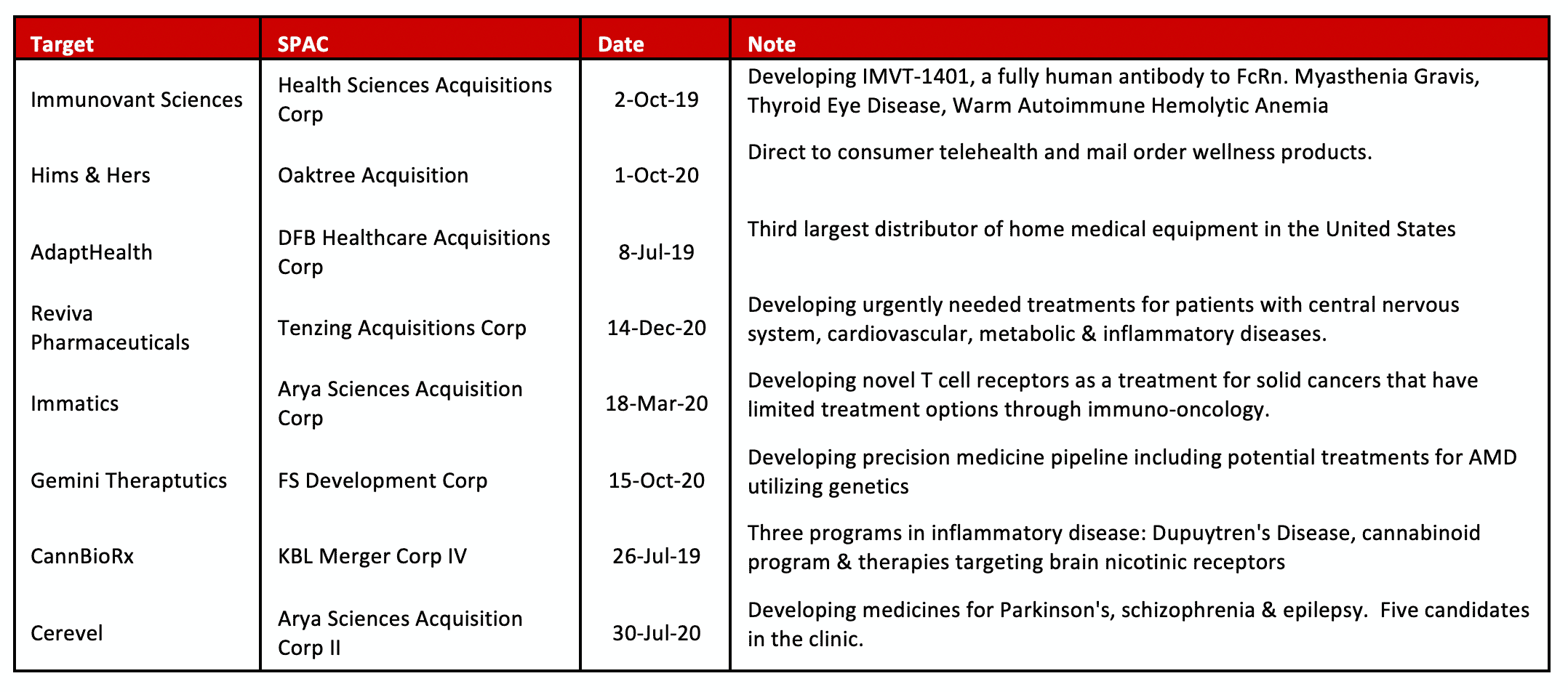

Some Deals that Closed

SPACs have from two to three years to find and close their acquisition. Several of the SPAC that emerged in 2018 and 2019 are now closing deals with their target companies. Below we provide a cross section of eight of the leading SPAC healthcare transactions. With the acceleration in new healthcare focused SPACs, we anticipate that many more deals will be announced in coming quarters.

Exhibit V – Closed Deals in Healthcare

Summary

Interest in SPACs has exploded over the last year with $83 billion in investments and 242 IPOs in 2020. The pace of IPOs in this class picked up in January bringing attention to the intermittently popular vehicle for taking private companies public. The SPAC raises funds from investors and is guided by a sponsor with attractive economics for closing a deal. Frequently, a specific geography and industry define the pool of investment opportunities. After the shell company identifies a target, investors are given an opportunity to vote on a transaction, with dissenting shareholders returned their money. With sufficient shareholder support, the targeted company will be acquired frequently with capital from other sources. The SPAC offers an alternative pathway to becoming public, providing competition to banks, who have been the traditional gatekeepers to the equity markets. While SPACs have a number of attractive features for investors, including liquidity and access to talent, they also can be dilutive for equity holders. A SPAC can act quickly to take advantage of opportunities but also may sidestep rigorous due diligence, increasing the risk of a bad deal. Overall, the instrument provides a powerful alternative to private companies seeking to become public and allow regular shareholders access some of the same opportunities as institutional investors.

1 Source: SPACInsider.com

2 Source: SPACInsider.com

3 Source SPACInsider.com and Thomas Wilburn, NPR.

4 Source: ARC Capital. What is a SPAC? October 19, 2017. arccap.us/arc-capital-is-looking-for-investors-for-his-new-spac-project/

5 Source: Luttig, John. SPAC Attack: everything a founder or investor should know. July 17, 2020. https://luttig.substack.com/p/spac-attack-everything-a-founder