2021 IPO & M&A Trends

Contributing Author John Vandermosten, Senior Biotechnology Analyst

Transaction Trends 2021: Pandora’s Box

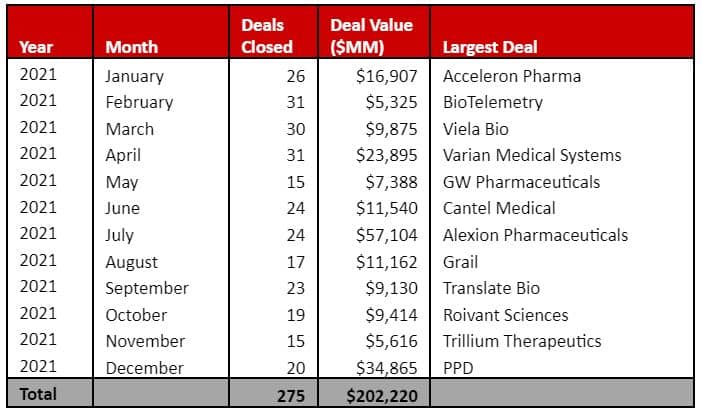

2020 was a tremendous year for Initial Public Offerings (IPOs) where 494 new issues came to market[1], but the achievement was eclipsed in 2021 with an all-time record of 1,058 companies going public. In healthcare/life sciences, we counted 118 IPOs in 2020, rising to an impressive 147 in 2021. Last year’s entries included companies ranging in market capitalizations from $12 million to $5.5 billion, including gene repair darling Sana Biotechnology and gene editing phenomenon Verve Therapeutics. On the M&A front, we counted over 270 transactions closing in 2021, ranging from AstraZeneca’s $39 billion buy of Alexion Pharmaceuticals to gene therapy companies Arctos Medical and Gyroscope Therapeutics, which were both snatched up by Novartis. The calculated value of transactions in 2021 was over $202 billion[2]. This compares to 350 reported transactions in 2020 totaling $238 billion[3].

Transaction Trends 2021: Pandora’s Box[4]

We saw IPOs in a broad range of specialties, with oncology and immuno-oncology making up the largest group at about a third of the total. Gene and cell therapy was another notable group along with CNS and neurodegenerative disease that contributed a number of new issues to the markets. Healthcare-focused special purpose acquisition companies (SPACs) generated six entries in the IPO group based on our count, while age-related and autoimmune disease offered three contenders apiece. Outside of therapeutics, diagnostic testing and drug development were represented with five companies each.

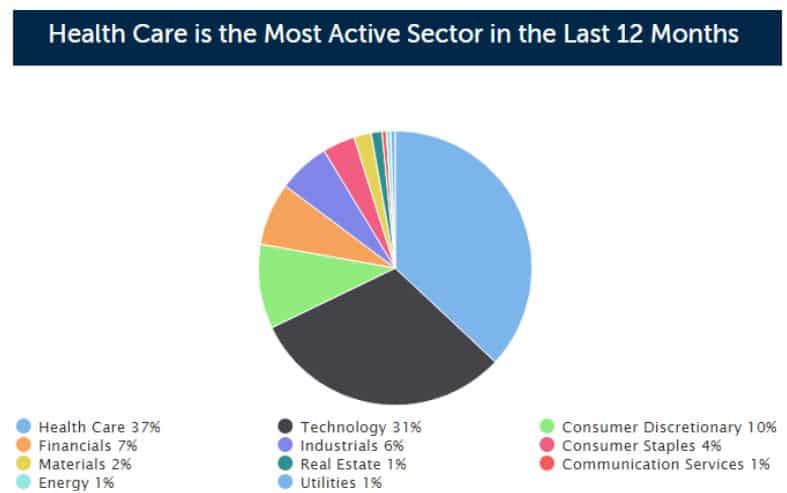

M&A above $100 million similarly focused on oncology with over 10% of the deals in this area. Other notable subindustries include diagnostics, mRNA, gene & cell therapy and cardiology. The biggest deal of the year was AstraZeneca’s buy of Alexion Pharmaceuticals, which closed in July. The combination helps advance AstraZeneca’s exposure in rare disease and immunology. One of the bigger deals outside of biopharma, coming in at $2.8 billion, was Philips’ (PHG) score of cardiology monitoring company BioTelemetry, recognizing the increasing importance of remote patient monitoring. Multi-billion deals in genetic testing (Illumina’s buy of Grail), RNAi (Novo Nordisk’s purchase of Dicerna Pharmaceuticals) and autoimmune and inflammatory disease (Horizon’s nab of Viela Bio) were other headline-grabbing transactions.

NYSE[4]

A year in review

The coronavirus impact was supposed to recede in 2021, vaccines were predicted to be broadly administered and supply chain issues were expected to be resolved. However, continued impact from the pandemic, trade tensions and bottlenecks led to shortages of almost every type of international commodity, from computer chips to reagents for medical testing and evaluation. Labor also experienced shortages, with many in the workforce electing to sit it out, a predicament most strongly impacting the service industry. Continued stimulus checks injected money into the economy; however, output and productivity lagged, leaving too much money pursuing too few goods. Inflation was another big factor, with travel and leisure, especially in automobiles, failing to provide sufficient supply to a population eager to get out. Lack of workers in both the US and around the world, some due to the “great resignation” and others due to quarantine, contributed to increases in food and manufactured goods prices. Energy and housing also saw large inflationary jumps. Life sciences is frequently immune to such impacts; however, anecdotal commentary suggests that many costs in the industry are rising while clinical trial progress slowed due to pandemic-related issues.

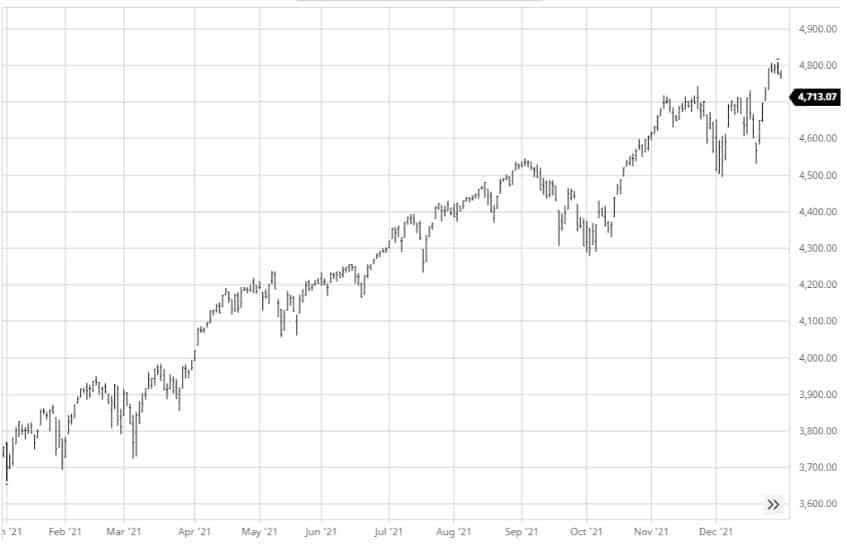

Equity Performance

While broader markets such as the NASDAQ and S&P 500 were up 21% and 27% respectively in 2021, the NASDAQ biotechnology index (NBI) was essentially flat[6]. The S&P Biotech Index’ 188 constituents saw a 20% decline in the year, reversing some of 2020’s 48% gain. For the broader markets, investors largely ignored the impacts of COVID on the economy and instead focused on strong demand across most sectors. Despite anticipated inflation, interest rates remained low, with the 10-year closing the year at 1.5%.

S&P 500 Performance, 2021[7]

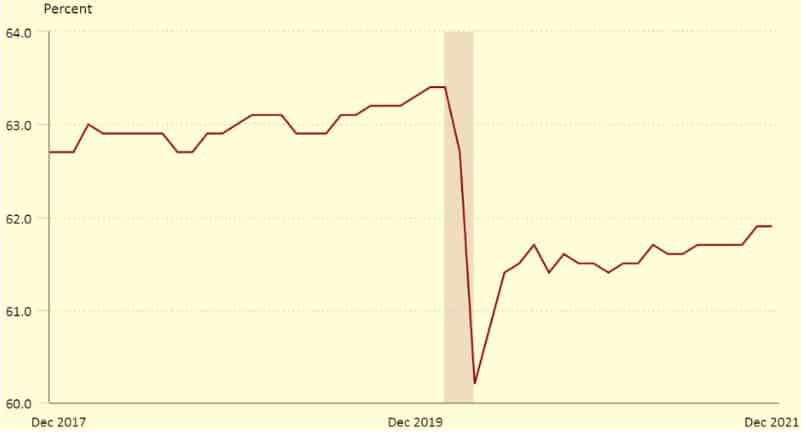

While market dislocations persisted, jobs numbers improved consistently throughout the year. The unemployment rate was 3.9% in December 2021, improving 2.8 percentage points over the prior twelve months, which equates to 4.5 million jobs added. Labor force participation was 61.9% in December 2021, still below the pre-pandemic 63.4% rate.

US Labor Participation Rate[8]

Factors Behind the Decline

Despite impressive headlines from Pfizer (PFE), Moderna (MRNA) and a return to interest in the neurodegenerative space with compelling data generated by Cassava Sciences (SAVA) and Prothena (PRTA), the wider biotech market experienced a weak year. IPOs reached record levels and may have diverted demand from existing issues. M&A was also slower on a year over year basis. Contributing factors to the weak performance include high valuations, regulatory concerns related to the FTC stifling pharmaceutical M&A, threat of forced intellectual property transfer for vaccines, and even the return of March-In-Rights for drugs developed using government funding. M&A is generally seen as an exit strategy for smaller, research and development-focused biotechs. When the excitement of being taken out by big pharma subsidies, so does interest in holding potential M&A targets

Nasdaq Biotechnology Index Performance, 2021[9]

IPO Drivers

Coming off of a white-hot 2020, investors and issuers were eager to take a bite of the IPO apple. January started slow with only 4 life sciences IPOs, but the trend accelerated quickly in February with 21 issues. The market took a breather in March to May with a total of 30 companies going public, but surged in June and July with 21 and 31 newly minted equities, respectively. The trend lost momentum after mid-year and there were only 40 more life sciences IPOs over the next five months.

IPO Industry Breakdown, Last 12 Months Ending January 20, 2022[10]

What Has Been Hot?

Coming off of a white-hot 2020, investors and issuers were eager to take a bite of the IPO apple. January started slow with only 4 life sciences IPOs, but the trend accelerated quickly in February with 21 issues. The market took a breather in March to May with a total of 30 companies going public, but surged in June and July with 21 and 31 newly minted equities, respectively. The trend lost momentum after mid-year and there were only 40 more life sciences IPOs over the next five months.

Annual IPO Activities by Year, All US Sectors[11]

Mergers & Acquisitions

We calculated 2021 M&A deal value at $202 billion compared to $238 billion in 2020.[12]

We calculated 2021 M&A deal value at $202 billion compared to $238 billion in 2020. 275 deals were reported in 2021, representing a 21% decline. Some of the bigger transactions in the period include Jazz Pharma’s (JAZZ) buy of GW Pharmaceuticals for their marketed Epidiolex product targeting seizures which was the first plant-derived cannabinoid medicine approved by the FDA. Merck (MRK) bagged Acceleron Pharma for $11.5 billion to gain access to the Pulmonary Arterial Hypertension (PAH) drug sotatercept on top of a diversified portfolio of assets. The spotlight turned towards mRNA when Novo Nordisk (NVO) laid out $3.3 billion to bring RNA interference trailblazer Dicerna into the fold.

In the gene therapy space, there was a modest amount of M&A activity in 2021. The largest gene therapy transaction was Lilly’s $1 billion purchase of Prevail Therapeutics, which uses adeno-associated virus (AAV)-based gene therapies for neurodegenerative disease. Urovant Sciences was bought by Sumitovant Biopharma whose secondary candidate URO-902 is a gene therapy for overactive bladder. Other acquisitions that closed during the year include Zikani Therapeutics, which was folded into Eloxx for its ribosomal RNA-targeted genetic therapy and Stelios Therapeutics, acquired by Lexeo, for its cardiovascular gene therapy assets. Biolife Solutions also got involved by spending $30 million to buy Sexton Biotechnologies, which develops bioproduction tools for cell and gene therapy.

Below we summarize the number and value of transactions as well as notable deals during the period.

Summary of 2020 M&A Deals[13]

Poising for a Resurgence?

2021 transaction trajectory built off of the strong momentum of the prior year, producing a record number of IPOs, 147 of which were in the life sciences space. Perhaps this was too much of a good thing, and the abundance of new issues saturated the market as the average IPO was down as of late January 2022. M&A was down year over year in terms of total transaction value and number of issues; however, key areas such as oncology, genetic testing and gene and cell therapy were all targets of the big players in the space. The most salient point for 2021 was perhaps the divergence of performance for the markets as a whole and life sciences names. The positive from this outcome is that the new IPOs have war chests of cash and compelling technologies that will be advanced in clinical efforts independent of market direction. If the science proves itself in the clinic, we expect shareholders to benefit from a new crop of candidates that can either be fuel for big biopharma or provide the impetus for internal development to serve the broad unmet needs in the health care space.

1 According to FactSet, there were 274 IPOs in 2018, 242 IPOs in 2019 and 494 IPOs in 2020 in all US sectors.

2 Source: EvaluatePharma. Of the 275 deals that were included in the summary, 148, or 54% did not disclose deal value.

3 Source: EvaluatePharma.

4 Credit: Nil Cayir, photographer

5 Arild Vagen, Intersection of Broad Street and Wall Street with New York Stock Exchange and the Federal Hall.

6 The NBI started the year at 4,759.14 and ended at 4,770.08, a 23 basis point increase. Not a lot for a year’s worth of work!

7 Source: barchart.com

8 Source: U.S. Bureau of Labor Statistics

9 Source: barchart.com

10 Data is for trailing 12 months as of January 20, 2022. Source: Renaissance Capital Website.

11 Source: Renaissance Capital Website. Note that Renaissance presents a different listing of IPOs that our other sources and the total numbers differ.

12 Evaluate Pharma M&A Deals from January 1, 2021 to December 31, 2021. Of the 275 reported transactions, 147 or 53% did not disclose deal value.

13 Source: Evaluate Pharma, January 2022, Evaluate Ltd. and author’s work. In this summary we include all reported deals, including those below $100 million and ones where no value was provided. There are a material number of transactions that do not include values and total deal value could be and likely is materially higher than the amounts listed.