ARM State of the Industry Briefing at JP Morgan Healthcare Conference 2018

Overview

Bob Preti and Janet Lynch Lambert, chairman and CEO of the Alliance for Regenerative Medicine (ARM), presented the “State of the Industry” briefing at the 2018 JP Morgan Healthcare Conference, the premier investment conference for biotech, healthcare, and pharmaceutical industries. ARM’s mission is to advance regenerative medicine. It is a global organization that brings together all stakeholders in the field to accelerate research, development, investments, and commercialization of regenerative therapies and cures. In their presentation, Preti and Lambert summarized recent advances in gene and cell therapy, including R&D, financial and regulatory developments, mergers and acquisitions, and reimbursement challenges. They discussed how the industry has seen an overall increase in investments and regulatory support in 2017. American Gene Technologies (AGT) was highlighted in ARM’s briefing (minute 9:30) on a list of companies and research institutions making advances in immune-oncology, under the category of Gamma-Delta cells. This recognition from ARM, a highly respected multi-stakeholder advocacy organization for the cell and gene therapy and broader regenerative medicine sector, strengthens AGT’s position as a leader in the field of regenerative medicine. AGT is a pioneer in immuno-oncology and has received the first patent for the stimulation of Gamma-Delta T cells for the treatment of solid tumor cancers. To view both the Alliance for Regenerative Medicine’s JP Morgan State of the Industry presentation, please see below. For more information about the Alliance for Regenerative Medicine and its mission, visit: https://alliancerm.org/

Video Recorded Presentation:

Video Recorded Presentation:

Speakers: Robert Preti, Chairman of Alliance for Regenerative Medicine and Janet Lynch Lamber, CEO of Alliance for Regenerative Medicine

Duration: 17:21

Welcome and thank you for attending the 2018 State of the Industry briefing for the regenerative medicine advance therapy industry. Wow, what a truly tremendous year this has been. We’ve had a number of S.O.T.L (State of the Industry) briefings over the years organized and delivered by on the Alliance for Regenerative Medicine and I think you’ll agree that this one will be like no other to date. Throughout my years in the industry each one has built on the last and although like any startup or set of technologies, growth has not been a straight line and nor do we expect it to continue to be. Each success and indeed each setback has provided an opportunity for us as a community to learn, to adapt, and to grow. And here in 2018 with the regenerative medicine industry experiencing a coming of age in 2017 a truly breakthrough year, a year in which we will see our products affect the lives of patients and their loved ones around the world. And to do so at a scale that we have yet to experience.

While we have had products in the market in the past, I think we can all agree that we’ve now crossed the line into a truly commercial industry. When I stood here a year ago speaking of the year to come, we knew that we were at an inflection point hoping for at least one major regulatory approval in the coming year and knowing that there could be as few as none or as many as three. An inflection point in a number of different directions. And what’s happened? We’ve had not one but three, forever changing the landscape of the way medicines are delivered to patients. Let’s pause for a minute and reflect on that. For this to have occurred, the rate of advancement of key environmental features had and must continue to accelerate to create the infrastructure capable of developing, approving and delivering and supporting these modalities. That includes scientific knowledge, patient advocacy, regulatory structure, reimbursement and market access programs and paradigms, manufacturing and delivery infrastructure, policy and more.

A year ago we shared concerns about the impact that a new administration in Washington would have on the regulatory environment and now that we could not be more pleased with the appointment and great work and tremendous support of Dr. Scott Gottlieb as commissioner including accelerated approvals and the RMAT (Regenerative Medicine Advanced Therapy) designation and with more to come. We’ve seen legislators share their concerns about bad actors and ask how can we help. A year ago we had concerns about how patients would gain access to these therapies should they be approved, given the then current models of reimbursement and now we are experiencing the very beginnings of industry and payers entering into partnership to find creative ways to smooth the path to market for this new generation of emerging medicines and treatments.

Today will look both back and ahead, back at the launch pad of clinical progress and financings in 2017 and ahead to the policy environment and anticipated clinical events of 2018. Yes, as with previous industries the challenges we face and will continue to face are unique to this industry. But again as with previous industries solutions continue to form directly around the lines of those unique challenges that are presented to us and this is no accident. Through its advocacy mission ARM (Alliance of Regenerative Medicine) empowers the community of multiple stakeholders and diverse stakeholders to promote legislative, regulatory, and public understanding of and support for this expanding field and our efforts are paying off to support the hard work and expertise of the diverse set of stakeholders in our industry. Through its regulatory agenda, reimbursement and market access initiatives, education and communications mandate, work in the area of manufacturing and standards, and facilitation of access to capital for its members, ARM (Alliance of Regenerative Medicine) continues to serve as the convening authority for the industry and a leading force in supporting the efforts of this industry to get these therapies to the patients that so badly need them.

There are now over 850 companies operating in the space and around the world with continued growth in each of the major markets and these companies are developing therapies over a number of therapeutic platforms and modalities including advanced cells such as modified T cells and hematopoietic stem cells and the like, cell based immunotherapies, novel and synthetic gene delivery vehicles, genome editing technologies and NexGen expression constructs.

Our work is not done and we anticipate that we’ll need to buckle up for the ride in 2018. Looking ahead, a critical MIT report cites an expectation that over the next five years we can expect to see another 40 cell and gene therapy approvals. We invite each of you to join us and become part of the voice that forever changes medicine. At this point I’d like to introduce Janet Lambert, our CEO, who will review the highlights of the last year and what we can expect to see in 2018. Janet.

Janet Lambert: Good morning. It’s my distinct pleasure to join you here for the first time in my new role as the CEO of the Alliance for Regenerative Medicine and to review with you the exciting clinical and financial results of this sector in 2017 and some of what we anticipate for 2018.

So many of you know it has been a very exciting year in this space as Bob already mentioned we have had a number of significant approvals, in just the last six months three products have been approved. Spark’s Luxterna just in December, Gilead and Kite’s Yescarta in October and Novartis’s Kymriah in August. All of these have applied for market access in Europe where they will likely be joined by TiGenex’s allogeneic cell therapy recently endorsed by the European Medicines Agency for the treatment of Crohn’s disease.

For those of you who aren’t familiar with ARM (Alliance of Regenerative Medicine) one of the major activities of ARM (Alliance of Regenerative Medicine) over the last two years has been the creation of a special regulatory pathway for regenerative medicines and advanced therapies called the RMAT (Regenerative Medicine Advanced Therapy) designation. This was signed into law 13 months ago and since that time 12 products have received the RMAT (Regenerative Medicine Advanced Therapy) designation. We are thrilled about the pace of implementation on the part of the FDA and as Bob said it’s part of an overall environment of great support for industry among U.S. and European regulators.

The pipeline for our sector is robust and growing, as you can see there has been significant growth in the pipeline and all phases over the last year including now 82 products in Phase 3. Of those 82 products, 30 are in gene therapy, 9 in gene modified cell therapy, 38 in cell therapy and 5 in tissue engineering.

As you can see the sweet spot of our space at the moment is oncology with more than 53 percent of products in the pipeline in this space, but you can also see from this chart that our products touch many indications and about 10 percent are in the cardiovascular space. Just to say a bit more about oncology and cell based immuno-oncology, this is not a comprehensive list of all of the companies in this space, but it is a list that gives you a sense of the breadth and depth of the activity in immuno-oncology in the early and later stages and makes the point that although there is a lot of excitement about the CAR-T space just now, that there is also exciting activity in TCRs, NK cells, TILs and other technologies. To also draw out a little bit of the landscape for gene therapy and genome editing, here too, we have substantial breadth compared to previous years covering both gene therapy and gene editing in vivo and ex vivo.

So one of the things ARM (Alliance of Regenerative Medicine) does is pull together from various sources a list of anticipated major clinical and data events for the coming year, for 2018. We will post this presentation on the ARM (Alliance of Regenerative Medicine) website following this presentation. So for those of you taking pictures of the slides, feel free to do that but you can also get them from our website. But also we will make available – I’m showing just here those things that are our late stage in near term major clinical events. We will also make available a longer list that includes earlier stage clinical events. For those interested in tracking the anticipated events and the progress of the field, this may be an assemblage of data that’s valuable to you.

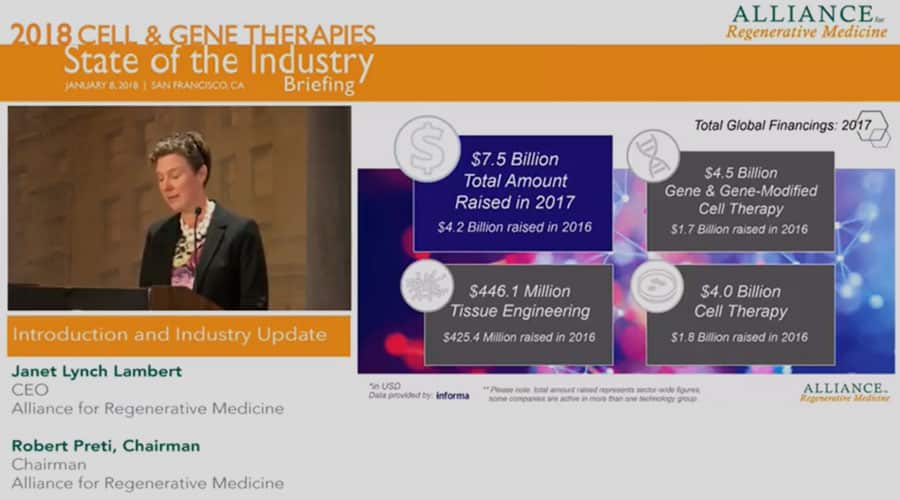

Moving on to financing, 2017 was a huge year for global financing, rivaling 2015 which has heretofore been the watershed year of our sector. As you can see here 7.5 billion was raised in 2017 in this sector, 4.5 billion of it in gene and gene modified cell therapy, up from 2.8 billion last year and 4 billion in cell therapy up from 2.9 billion last year. There are a number of significant events obviously which make up these numbers and we’ll go into them in a little bit more detail in a moment. So the financing also took many forms. As you can see follow-ons dominated the financings last year, venture capital also quite strong, a number of significant corporate partnerships were also formed with meaningful upfront payments, here again we’ll provide a little bit more detail in subsequent slides.

You know we couldn’t not pause for a minute and talk about the M&A (Mergers and Acquisitions) activity in this space. Obviously that Gilead/Kite transaction was a major moment for our sector and drove much of this $13.5 billion M&A (Mergers and Acquisitions) number, but it wasn’t the only significant M&A (Mergers and Acquisitions) transaction in our sector this year. The Sanpower Group completed the Dendreon acquisition for 819 million. Gilead also acquired Cell Design Labs for 567 million, CSL Behring acquired Calimmune for 416 million and more. Even without the huge Gilead/Kite acquisition the M&A (Mergers and Acquisitions) upfront totals for 2017 still reached $1.6 billion, which is a 55 percent increase from 2016 and nearly on par with 2015.

Here’s a little bit more detail about some of the corporate partnerships and collaborations and public financings that we saw in this year. Numerous high value deals were closed in 2017 across technology types and geographies. Follow-on financings were especially significant in 2017. Noteworthy is the fact that three companies raised in excess of 400 million dollars, Bluebird, Kite, and Spark while there were also significant venture capital financing in the space. Much of the headlines were dominated by CAR-T, gene therapy and gene editing activity, but there was a wide variety of activity last year.

This may please the investors in the crowd, we keep an index of our sector and track it against the Nasdaq biotech index as well as the Nasdaq index broadly and you can see that both the sort of composite regenerative medicine advanced therapies index, the cell based immuno-oncology index and the gene therapy index exceeded the Nasdaq and the Nasdaq biotech index.

This, I should note about what’s included in these indices that we track are public companies that are primarily in the regenerative medicine and advanced therapies phase. So these data do not include large pharma.

So to reiterate some of the conclusions that Bob drew earlier, we feel that 2017 was a real turning point in the maturity of our sector. We saw significant product approvals and we anticipate many more to follow. We see growing public awareness, recognition and enthusiasm for the sector. We have a regulatory environment both in the U.S. and Europe, which is unusually enthusiastic about this space and committed to seeing this space succeed. We see financial maturity across many aspects of this space and a very positive investment climate for this sector. We recognize that there are still needs to provide support for this industry that we have challenges in the reimbursement domain, the regulatory domain, industrialization and manufacturing and we aim to address them.

So let me just close to say part of the environment that is very important to the success of this industry is the policy environment, the regulatory environment, and the reimbursement environment in particular that surround our sector. ARM (Alliance of Regenerative Medicine) is deeply involved in interactions with policymakers around all of the core issues for this sector. Here we described some of the main activities, the RMAT (Regenerative Medicine Advanced Therapy) designation last year; I discussed earlier going forward we anticipate a number of significant regulatory decisions in the U.S. in Europe that will shape the opportunity of this sector, and we recognize that the products in this space create reimbursement challenges to the normal way of doing business, which isn’t set up to anticipate curative onetime treatments but is more geared to an system of small payments over time. So we will be actively involved in those deliberations on behalf of the sector and in collaboration with the sector, and we look forward to sharing both the developments on the financing front and the clinical front and the policy front with you as the year goes on.

With that I’m going to turn it back over to Bob Preti and the next panel, on next generation CARs (Chimeric Antigen Receptors) and other cell based immunotherapies. Thank you very much.

For more information about the Alliance for Regenerative Medicine and its mission, visit: https://alliancerm.org/